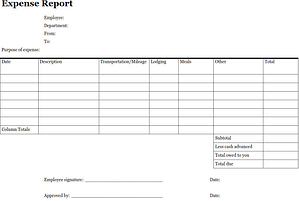

Many years ago, small businesses adopted preprinted employee expense report forms. The use of a standardized form was an attempt to have employees enter all of the information necessary to properly categorize the expenditures. Employees were instructed to staple all of the supporting receipts to the form, which then was physically passed on to the supervisor for review. The supervisor reviewed the receipts, and ostensibly checked whether there were enough of them to cover the reimbursable amount claimed by the employee.

On occasion, a form would be sent back to the employee for revision, but if all was good, the supervisor sent the little bundle of paper down the hall to the accounting department. With a little luck, the form arrived with all its attachments at the Accounts Payable office. The A/P personnel then had to again match the receipts to the amounts claimed, check the total, code the expenses and enter the transaction into the payable system. This was no small chore for companies with many employees in the field, and soon their file cabinets were bulging with all of the vouched and supporting receipts.

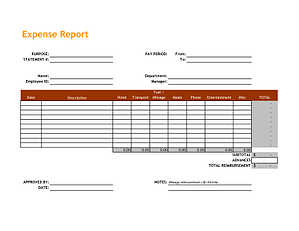

Next, only a couple of decades ago, after Microsoft Excel came along, someone got the idea of having employees complete an expense report using an Excel template. The template had some terrific features like ensuring that expenses extended and footed properly. The completed report could be emailed to the supervisor, who would again electronically forward it on to accounting (via email) after approval. The paper receipts either followed separately or were converted to .pdf and also attached to the email with the expense report. Accountants rejoiced as this cut down the incidents of math errors and lost paperwork. This method endured, despite the fact that the expenses still had to be manually entered into the accounts payable system. Additionally, every time a new expense category or department was created, the template had to be revised.

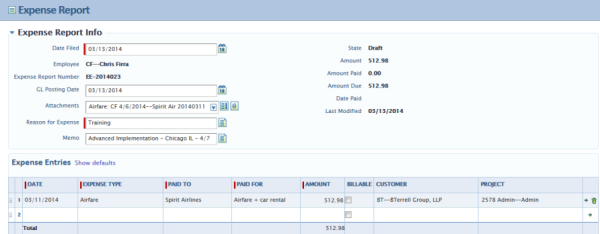

Within the last few years, wonderful new travel & expense report automation has become available for small business. In our office, we utilize the expense report feature of Intacct's Time and Expenses module. It provides each employee with a quick way to enter expenses that are properly coded with valid general ledger account and project number. Additionally, scanned receipts or photos can be attached to the report to provide necessary support. Once entered, the expense report appears on the supervising employee's dashboard for review and approval before becoming available for payment. The real net gain is that an accountant does not need to reenter the transaction, much less make sure that the report foots. Incidentally, Intacct offers a less expensive "employee user" license that provides dashboard access as well as expense report entry and approval.

For other organizations, a more full-featured integrated travel & expense management application may be appropriate. Web-based travel & expense solutions such as Concur, Expense Cloud and Expense Anywhere enable employees to capture receipts and and submit reports from their mobile devices. Most can also retrieve corporate credit card transactions and support rules to evaluate expense amounts at the time of entry. The application programming interface (API) of both of our core accounting offerings, Sage 300 ERP and Intacct, enable integration with these solutions, eliminating additional data entry.

If you find that your accounting personnel are spending too much time handling travel and expense reports, it might be time to allow your process evolve, especially if your process still involves paperwork. Feel free to call BTerrell Group to discuss integrated expense management options that will work with your accounting system.