Guest blog post

by Carrie Tumey, Regional Sales Manager

Avalara

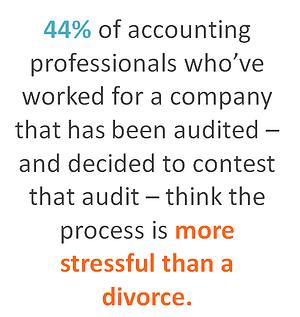

Tax compliance. It is one of those tasks that can drive your accounting department or bookkeeper crazy. It’s also an unavoidable, statutory requirement. Undoubtedly you have developed a process that works, but do you know how that process will hold up in an audit? With an average audit penalty of $34,000 and the average total cost for a business to manage a sales tax audit of $96,552, most companies cannot afford to make a mistake, even if it’s a little one. The consequences of making mistakes are dire.

In a time where states are short on revenue and looking at uncollected sales and use tax and exemption certificate mismanagement to help make up that gap, tax compliance practices are increasingly under the microscope. Now is a great time to examine your how you’re managing compliance and determine just how much risk you carry. Here are a few things to consider:

Are you manually managing sales & use tax in Sage 300 ERP?

Are you manually managing sales & use tax in Sage 300 ERP?

Perhaps you look up tax rates by ZIP code or download rate tables to update in Sage 300. This can be time consuming and error prone. Rate tables have to be continuously updated with rates that are constantly changing and State websites aren’t always reliable. ZIP codes were created for the postal service and do not always line up with taxing jurisdictions. Relying on ZIP codes to determine tax rates can mean over or undercharging your clients.

Does the taxability of your products vary by jurisdiction?

Products that are taxable in one state may not be in another. In some states, for example, candy that contains flour is not considered “candy” for sales tax rate purposes and is taxed at a lower rate than at a combined state and local sales tax rate.

Are you doing business in multiple states?

Instead of thinking of sales and use tax obligations in terms of where your business is located, think about where you do business and the activities you engage in within those states. Why? Rules vary from state to state when it comes to what creates sales tax nexus. For example, certain trade show activities can trigger sales tax liability in Illinois, Texas, Nevada, Florida and California.

How are you managing exemption certificates?

Most businesses have a combination of fixed assets and inventoried items, which means you’re likely not just dealing with sales and use tax, you have exemption certificates that need to be managed. Improper exemption certificates management is one of the top sources of negative audit findings. If you don’t have a clear process set up to protect yourself and prove you’re exempt from tax, you could be setting yourself up for trouble.

Reduce your risk:

Tax compliance is tricky, especially when manually keeping up with rate, rule and boundary changes in multiple jurisdictions. Reduce your risk of a negative audit by taking time to examine your compliance process and develop a consistent, defined work flow. Then, look for ways to increase tax calculation accuracy. Automating the tax calculation and decision process can save time, money and effort. Sage Sales Tax works right inside Sage 300 ERP and automates the transactional tax process, helping you achieve compliance and accuracy across the board.

For more information on how to reduce your risk, join us for our FREE, upcoming webinar:

Webinar: Automating Sales & Use Tax in Sage 300 ERP