Common Questions Re: Generating 1099-MISC Forms from Sage 300 ERP

This time of year, we usually receive several phone calls regarding the printing of 1099-MISC forms for vendors paid during the previous year. You likely already know that 2013 1099-MISC Copy B and Copy 2 forms should be sent to the payee by January 31, 2014, and that Copy A must be filed with the Internal Revenue Service by February 28, 2014 or by March 31, 2014, if filing electronically. Here are several questions that we receive each year and responses.

Where can I get compatible pre-printed 1099 forms?

Forms and envelopes may be ordered from Sage Tax Forms, or purchased at your local office supply store. Keep in mind that you may need to print a test form or two, utilizing the Align button to adjust your printer’s alignment.

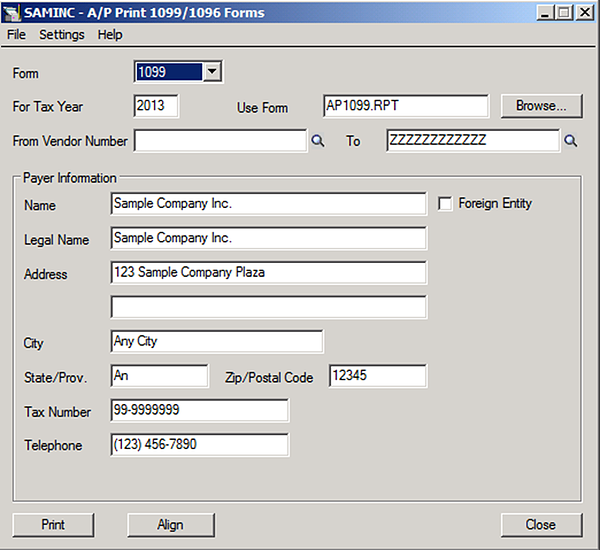

How can I print the 1099-MISC and 1096 Transmittal forms?

You may print these forms from the 1099/1096 forms icon in A/P Vendors Reports folder. A selection box in the user interface allows toggling between forms.

Make certain that the name, address and tax number for your company are showing correctly before clicking the Print button.

Why would some vendor 1099 forms be missing?

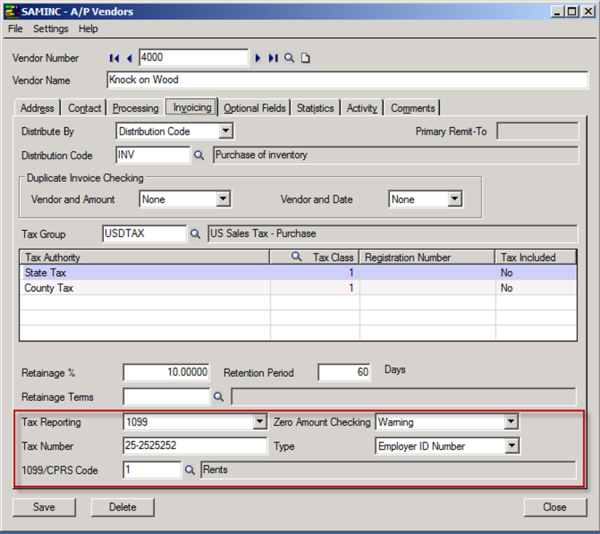

Payees must first have been set up to record 1099 amounts in the A/P Vendors-> Invoicing tab.

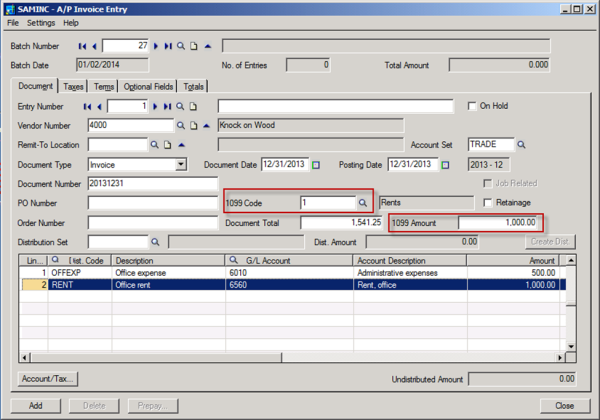

Make certain that the Tax Reporting selection box has been set to 1099, that the Tax Number is entered according to the vendor's form W-9, and that the 1099 Code selected is appropriate. Additionally, note that 1099 amounts must have been entered for the vendor, which is usually done at the time of A/P invoice entry.

Setting the Zero Amount Checking option to Warning in the vendor record will help remind the user doing invoice entry to populate the field. Additionally, you may configure Sage 300 ERP to default the 1099 amount from the invoice amount from within the A/P Setup user interface.

Additionally, remember that each 1099 code type has a different payment amount threshold that must be reached ($10 for royalties, $600 for rents, $5000 for direct sales, etc.), which may also result in a payee being left out of the 1099 form printing.

How does Sage 300 ERP calculate the amount on a 1099?

Sage 300 ERP records the 1099 amount from each paid invoice into the 1099 table. Therefore, only 1099 amounts related to invoices paid during the calendar year will appear on the forms.

How can I verify that the amount showing is correct?

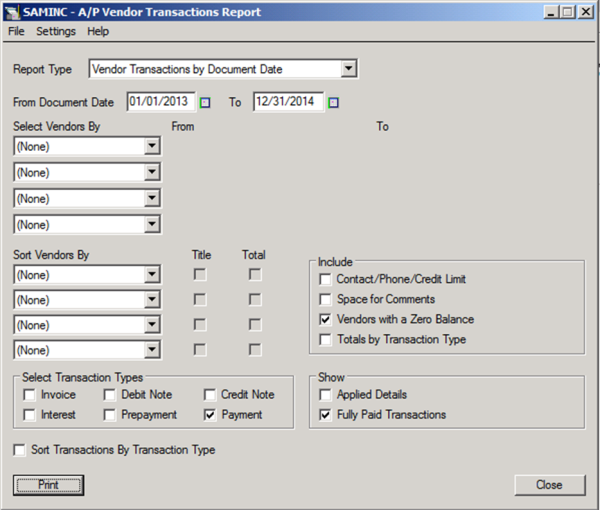

Unfortunately, there is no standard report that shows the detail of invoices that make up a 1099 amount. Such a new report can be created in Sage Intelligence, Crystal Reports or other reporting tool. At minimum, we recommend printing the A/P Vendor Transactions Report by Document Date configured to include only payment transaction types. This will provide a total of payments made for each vendor that can be used to compare to the 1099 amounts and may help in identifying missing vendor 1099s.

How can I correct the amount printed on a vendor's 1099?

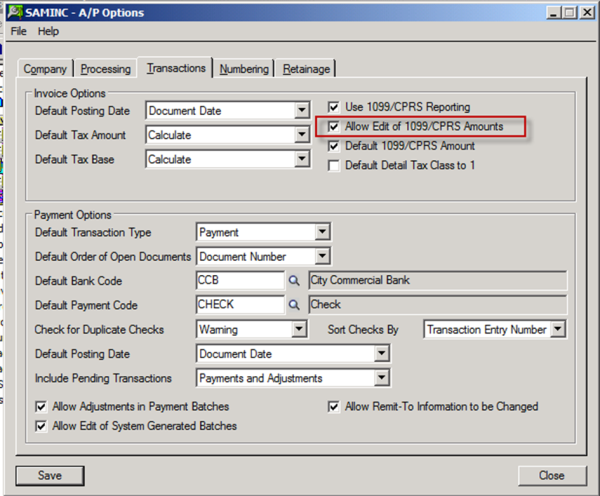

First, make sure that Allow Edit of 1099/CPRS Amounts is enabled in the A/P Options->Transactions tab, which is located in the A/P Setup folder.

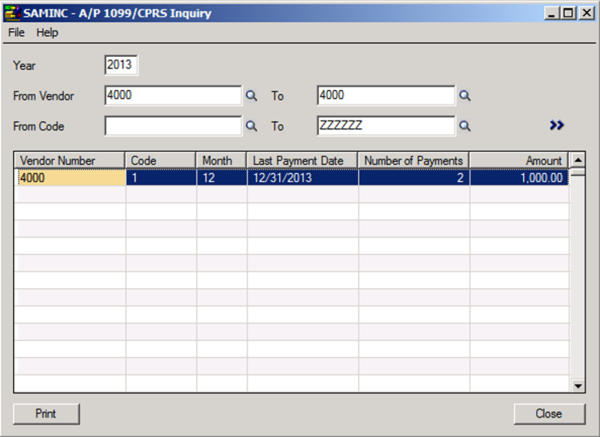

Next, open the icon called 1099/CPRS Inquiry in the A/P Vendors folder. Make sure that the Year field is set correctly. Next, enter the vendor that you wish to update in both the From Vendor and To Vendor fields, and then click the Blue Arrows  to populate the inquiry list below. To change the amount, simply double-click into the Amount field.

to populate the inquiry list below. To change the amount, simply double-click into the Amount field.

Also note that there is a Report called the A/P 1099/CRPS Inquiry available on the File menu of this UI, which may be used to view all 1099 amounts for a given calendar year.

How can I put a vendor's legal name on a 1099 form?

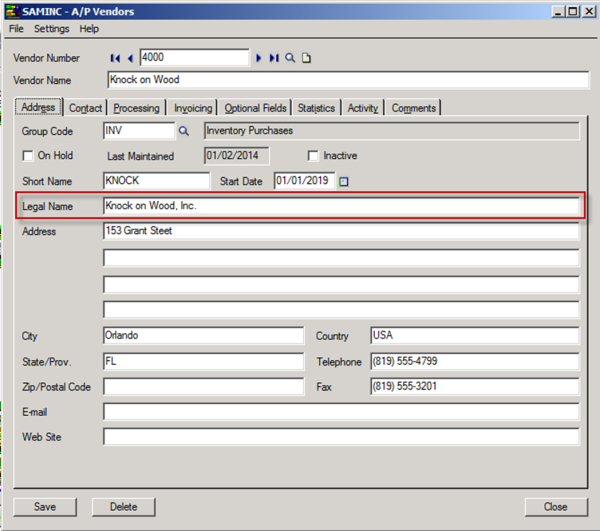

Newer versions of Sage 300 ERP Accounts Payable have a new "Legal Name" field in the A/P Vendors UI. Once populated, the name entered here will appear on a vendor's 1099 form.

How do I transmit 1099-MISC Copy A electronically?

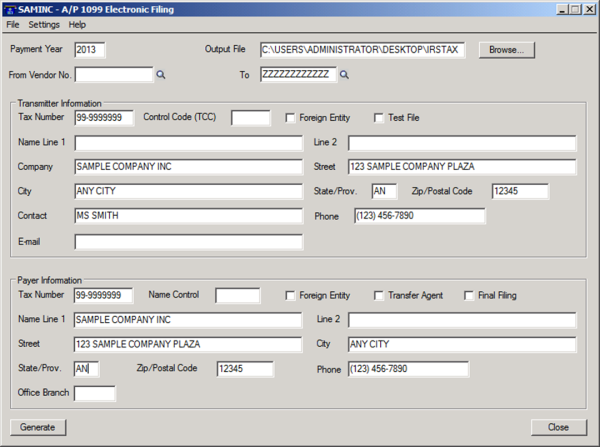

Payers filing more than 250 forms are required to file 1099 MISC Copy A electronically. Sage 300 ERP enables this using the A/P 1099 Electronic Filing user interface, which is located in the A/P Periodic Processing folder. Set the Output File location by clicking Browse. Once again, review the payer and transmitter name, address and tax numbers carefully, before clicking Generate.

1099-MISC files may be transmitted using the IRS FIRE system. If the number of 1099s is large, it may be necessary to create 2 or more files because of the IRS' file size limitations. Please see IRS guidelines for more information.

Need additional help or guidance? Don't hesitate to contact the experts at BTerrell Group!