In many ways, performing an effective monthly financial period closing is similar to carrying out a successful implementation project. Each closing requires a good plan, effective communication among participants, someone that can control activities and risks, and ideally, a review at the end to learn from mistakes and identify opportunities for improvement. Like a project, a closing must adhere to a defined schedule and meet quality objectives for the deliverables, that is, financial statements that accurately portray results and are free of material errors. The personnel, systems, and processes are equally essential.

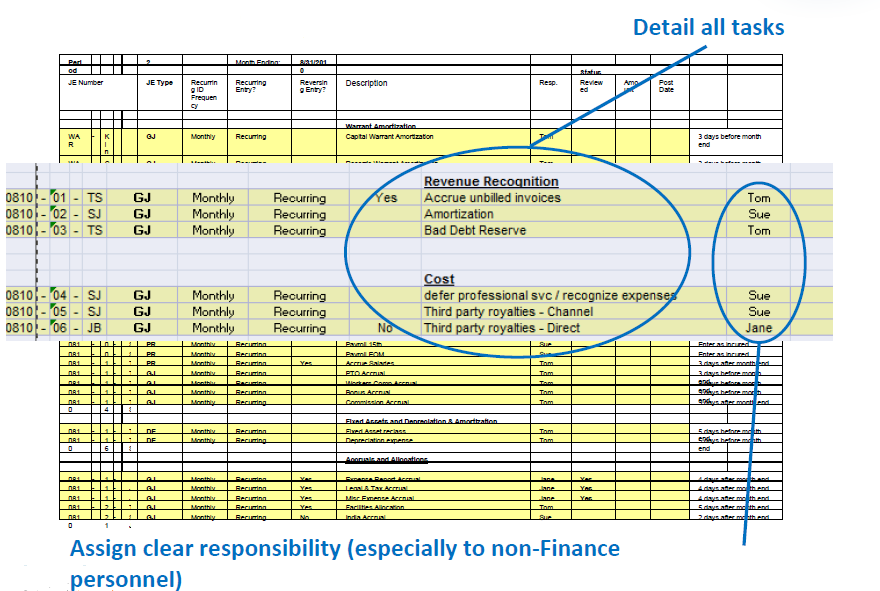

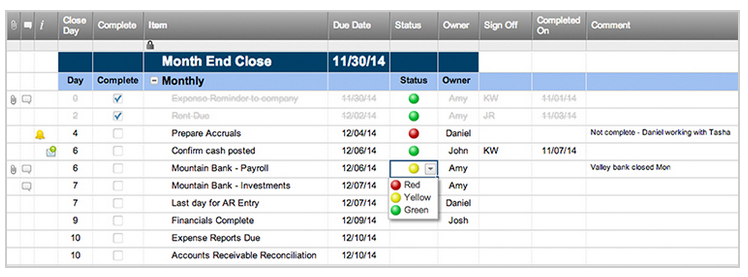

Every good controller works from a monthly closing plan or checklist that is honed from experience. At a minimum, it identifies the closing tasks, when tasks must be completed, and the person responsible for carrying them out. The listed tasks typically include each of the regular journal entries, each of the account reconciliations, as well as each financial report review. As tasks are completed, they are checked off, so that the unfinished tasks are clear. While the plan may remain the same from one month to the next, it must be updated as conditions, requirements, and resources change.

Communication with all participants is critical to a successful close. This includes publishing the accounting calendar, closing schedules, and providing users with access to your plan. Regular meetings with participants (accounting team and contractors, if any) during the close can help ensure that issues are addressed quickly and that schedules stay on target. A common file repository in a secure shared drive is a great way to share documents and artifacts such as the closing plan and checklists. Even better, consider using a SaaS-based collaboration and content management site like SharePoint Online or Smartsheet.com to maintain the closing plan, issues lists, and to store key closing documents.

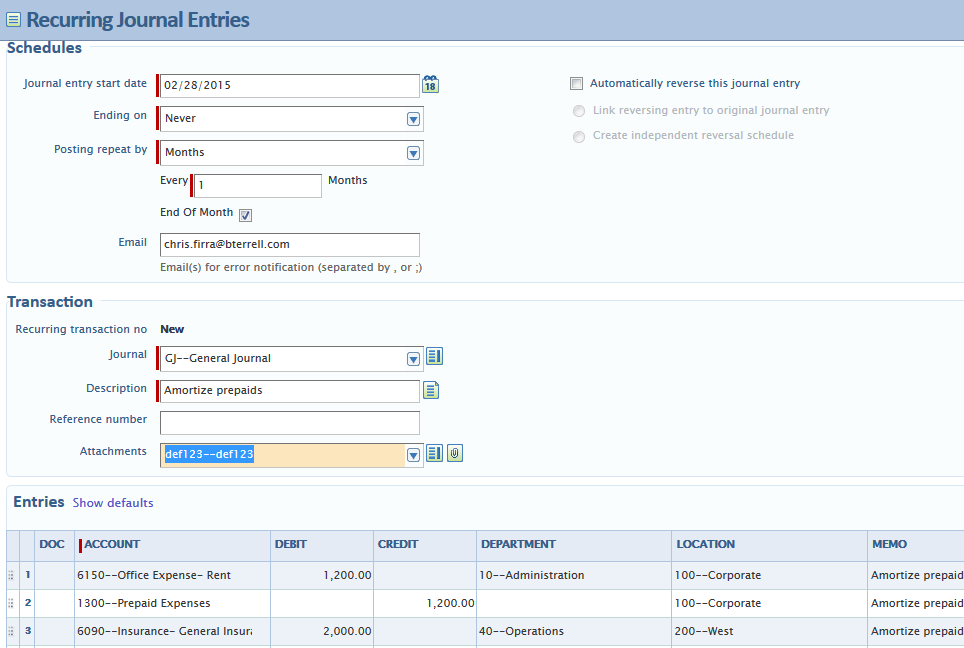

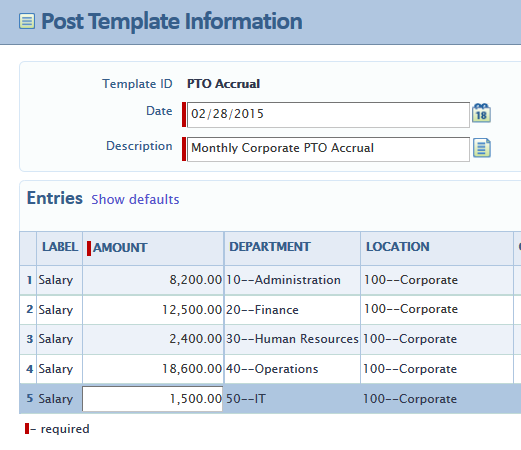

The efficiency of completing accounting tasks also is important to meet reporting deadlines, and use of automation in modern accounting systems can make a difference. For instance, Intacct's Recurring Journal Entries, once set up, post automatically according to a defined schedule. This not only saves labor, but it also ensures that transactions are correctly coded and timely. Similarly, creating transaction templates in the accounting system or in importable worksheets add to efficiency as well as accuracy. Worksheets, once imported, should be attached the journal entry to save time during the controller's review and to document and support the transaction in future audits.

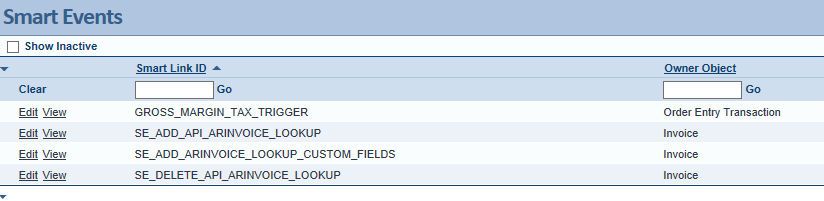

Part of the controller's role during closing includes managing and minimizing risks and errors. Well-configured accounting systems assist the controller by providing "Preventive Controls" that are built into user interfaces, eliminating some types of errors from ever being introduced. For example, the system may validate amounts or limit the use of certain general ledger accounts without proper authorization. Enforcing transaction cut-offs by closing a sub-ledger such as Accounts Payable for the previous accounting period can prevent new transactions from creeping into the period, post-close. Additionally, some systems also have rules-based "Detection Controls" that alert managers of potential errors found in accounting data. For instance, Intacct's Smart Events can create emailed notifications when transactions meet specified criteria.

Unfortunately, system error controls are never enough to prevent all errors, so, the closing process must include reconciliations and reviews to ensure that account balances are correct. Wherever possible, perform reconciliations through the system rather than in off-line spreadsheets that may be prone to error. Most accounting systems provide bank account reconciliation functions, and some such as Intacct, provide functions to reconcile company credit cards. Every account should be reviewed and reconciled on a monthly basis.

One good practice is to make certain that at least two people review each financial report. The design of reports can sometimes help identify errors. For instance, trending reports often makes errors stand out. When ready for publication, the distribution of financial reports through email or by publication to dashboards can ease the burden on the accounting team and help ensure that reporting requirements are met.

Finally, the controller should consider holding a post-mortem meeting with the entire team following each completed closing. Issues and solutions found during the closing should be highlighted and discussed to avoid or minimize future problems. In some cases, the value of developing new reports and automations can become evident during the post-closing review, so be sure to document the findings. Additionally, point out tasks the team performed admirably as well as those that need improvement, as this will provide an opportunity to share knowledge and best practices among team members.

Sources:

"Building Blocks of a Successful Financial Close Process", Journal of Accountancy, November 30, 2011

PowerPoint from a lecture titled "Creating a Basic Monthly and Year-End Close Process" given by Marc Linden and Teresa Ruppel on 10/28/2010.