Read MoreLike many accounting and financial technology professionals, I am busy getting up to speed on best implementation practices for ASC 606, Revenue from Contracts with Customers. ASC 606 takes full effect for both public and private companies within the next several years, and applying the new guidance won’t easily happen without adequate planning and effort. Here are highlights to consider thus far.

BTerrell Group Blog

Revenue Recognition: Moving Forward with Implementation

Posted by Brian Terrell on Fri, Mar 23, 2018

Tags: RPA_Lead_Story

Brian Terrell Talks About Software Automation on the Sage Advice Podcast

Posted by Brian Terrell on Mon, Mar 19, 2018

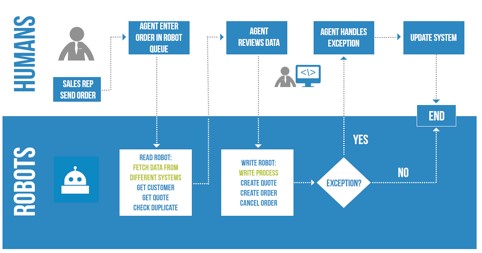

Brian Terrell visits with host Ed Kless on the Sage Advice Podcast about software automation, Artificial Intelligence, and Robotic Process Automation (RPA). The BTerrell Group assists small and midsize businesses automate internal business processes using Sage Software and automation tools, including RPA.

Read MoreTags: RPA_Lead_Story

Your Five-Step Program to Revenue Recognition Compliance

Posted by Brian Terrell on Fri, Mar 02, 2018

I’ve been writing a lot lately about the new revenue recognition standards (created by ASC 606 and IFRS 15) companies will soon need to adopt to ensure compliance. Granted, it’s a complex and somewhat dry topic, but it’s one poised to have a tremendous impact on public and private companies alike. Since most of us aren’t accountants (full disclosure – I am, but not practicing), I thought it could be helpful to boil down the changes to the five core steps to compliance.

Read MoreTags: RPA_Lead_Story

Transitioning to ASC 606? Which is right for you - modified or full retrospective?

Posted by Brian Terrell on Fri, Feb 23, 2018

Companies have two options when implementing the new Revenue from Contracts with Customers standard, codified as ASC 606. You can take a retrospective approach or a modified retrospective approach. Both approaches require significant effort to account for contracts under both the old and the new guidance before and during the transition year, and clients with whom we’ve spoken express concern that this parallel processing is the greatest single challenge currently offered by ASC 606. Let’s take a quick look at each approach, and offer a few reasons why a company might choose one over the other.

Read MoreTags: RPA_Lead_Story

The new ASC 606 standard has some 'Gotchas'. Distinct or a Bundle?

Posted by Brian Terrell on Fri, Feb 16, 2018

The confusing complexities that just may come back to bite you

In our continuing series covering the major and minor points of the new Revenue Recognition rules contained within ASC 606, we wanted to shed some light on some of the nuances laced through the rules’ verbiage. While on the surface the rules sound fairly straightforward, there are some confusing complexities that it’s important for your organization to be aware of and to understand. Here we look at just one component of the rule – identifying the performance obligations of a contract - to illustrate how a seemingly simple concept gets a bit more complicated the deeper we look.

Read MoreTags: RPA_Lead_Story