by Chris Firra

In a previous article, I posed a question of how Intacct could be configured to provide sales tax compliance for a multi-state services company. In that article, we reviewed Intacct's Advanced Tax configuration, and found that it could enable accounting departments to "in-source" the company's sale tax calculation and reporting, but did not offer much help in simplifying the chore of keeping track of new jurisdictions and tax rates.

The alternative to in-sourcing, is of course, outsourcing. Outsourcing tax compliance is nothing new. CPA firms have always performed these types of services for small businesses. What is relatively new are the technologies that enable automated sales tax outsourcing that is fast, efficient, and cost-effective. This is leading to an in increased use of outsourced tax compliance services. A 2011 survey of the readers of AICPA Corporate Tax Insider found that more than half of the respondents reported that they were outsourcing some aspect of their tax function and even more were planning to do so in the future. Not surprisingly, the predominant reasons cited were (1.) to "increase time for higher value activities", and (2.) a "lack of qualified tax professionals."

The prime example when it comes to Intacct of an integrated provider of sales tax compliance is the subscription-based AvaTax from Avalara, a SaaS provider of sales tax automation. AvaTax utilizes Intacct's web services API to seamlessly identify correct tax jurisdictions and tax rates related to sales and purchases transactions and then return the correctly calculated sales tax amounts for customer invoices. AvaTax outsources the accounting department’s burden of maintaining jurisdictions and tax rates in Intacct.

Let’s review the steps to configure AvaTax for Intacct:

Step 1: Subscribe to AvaTax from Avalara either by contacting BTerrell Group, or directly contacting Avalara.

Step 2: Enable Avalara AvaTax in Intacct from the Company Subscriptions screen.

Step 3: After receiving login credentials from Avalara, Configure AvaTax in the Avalara customer dashboard, where one or more Intacct companies may be added. For each company, the required jurisdictions may be selected and subscribed, by area, state or country.

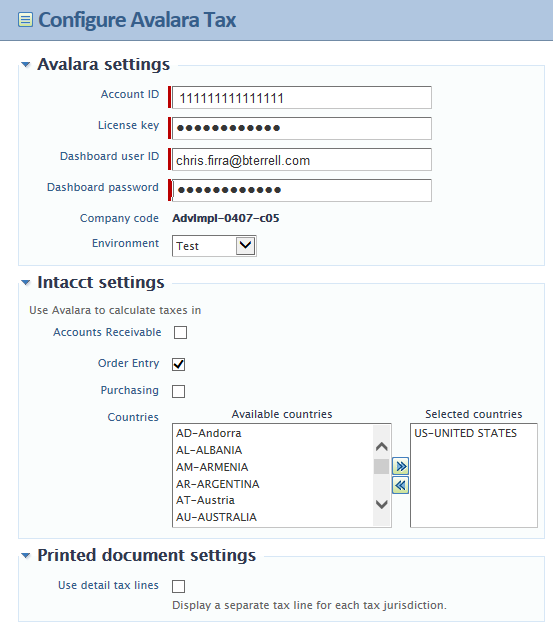

Step 4: Intacct must be configured to connect to AvaTax. The information necessary to make a web services call to AvaTax must be entered, consisting of the following:

- Account ID

- License key

- Login ID

- Login password

- CompanyID (Note: it's a good practice is to use the corresponding Intacct Entity ID as the company ID in AvaTax in order to make set up simpler.)

Additionally, turn off any active Intacct Tax Schedules used previously.

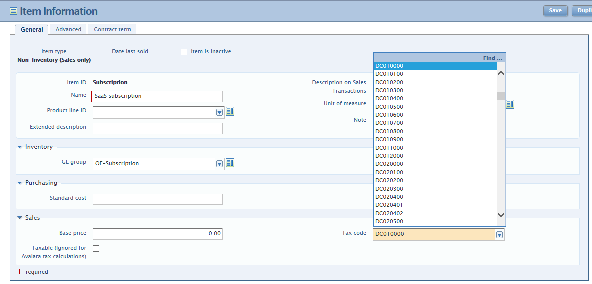

Step 6: tag each Intacct item (both inventory and non-inventory) with the appropriate Avalara Tax Code, which assigns the tax treatment classification. This step is critical, but rest assured that the implementation team at Avalara is prepared to assist with questions regarding proper coding. Also note that item updates may be imported from a .CSV file.

After these steps have been completed, Intacct is ready to calculate correct tax amounts and Avalara is ready to track and report taxable sales for reporting. At the end of each reporting period, AvaTax generates summary reports and data exports that may be used to facilitate report preparation as well as detailed reports to provide full accountability and auditability. Alternately, Avalara Returns will file returns and remit tax payments for fully outsourced sales tax compliance management.

When evaluating the two approaches presented, it's fairly clear that in a multi-state environment, using sales tax automation from Avalara provides greater simplicity and efficiency, especially when operating with a "lean" accounting staff (and who doesn't these days?). Contact BTerrell Group if you'd like more information regarding maintaining sales tax compliance with Intacct.