Written by Hrayr Galoyan, from BTerrell Group's sister company, CodePartners

With Internet sales tax legislation looming, many business owners may be wondering how they will handle the additional burden of collecting and reporting sales taxes for all states. Fortunately, technology exists to help. Best of all, much of it is free.

Let's start with a paid option. Avalara provides software to handle sales taxes. In the company’s words “AvaTax Calc is an easily integrated, dynamic tax decision engine.” It is already integrated with many accounting, ecommerce, and POS systems, including our partner, Intacct. In fact, here's a demo of AvaTax for Intacct. For other integrated systems, visit Avalara. AvaTax is free for those transactions covered under the Streamlined Sales Tax Agreement. They also provide a free lookup of sales tax rates on their site.

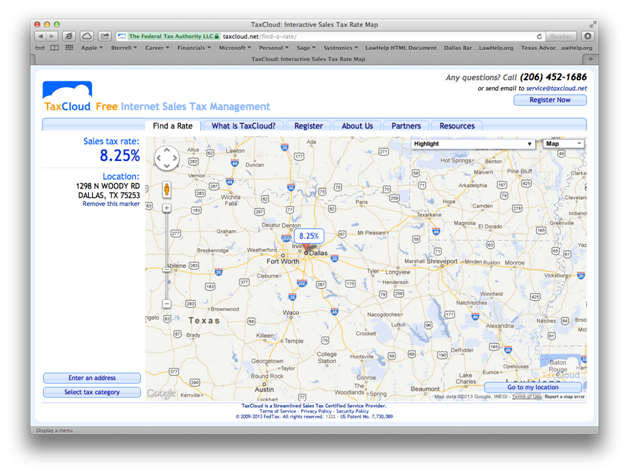

Another option is a company called TaxCloud. TaxCloud itself is free, and provides tax rate lookup for any US address. If you use the Streamlined Sales Tax Agreement, it can also keep track of sales transactions and tax amounts collected and file sales tax returns. Programming interface is available to integrate with any ERP, e-commerce or POS system, and many already have done so.

If you just want to look up a tax rate, you don’t even need to register at TaxCloud. Simply click on the map, or enter the address. Below is an example for Dallas, Texas.

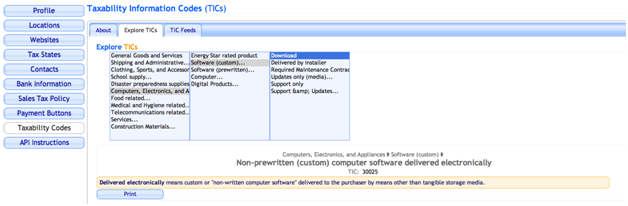

Sales taxes can get more complicated than just one rate. At the same address, some items may be taxed differently than others. For example, alcohol may be taxed at a higher rate than consumer electronics, and some grocery products may not be taxable at all. Tax Cloud supports “Taxability Codes”.

This requires your accounting package to be integrated with TaxCloud. Each item in your product list is assigned a taxability code, and when the software requests the tax rate from TaxCloud, it automatically provides the correct rate for the type of product you are about to sell.

For more information about sales tax, here are a couple of articles I thought were interesting. This article in CNN discusses what to expect from Internet sales tax legislation.

This excellent article looks at possible compliance pitfalls, and I highly recommend you read it if you have out-of-state customers, even if you don’t have a nexus in those states.