1099 reporting only happens once a year, so it is no surprise that we all forget the process to get these forms printed and distributed in a timely manner. Here's a quick link to our post from last year on Common Questions Re: Genertaing 1099-MISC Forms from Sage 300 ERP.

Read MoreBTerrell Group Blog

Michelle Tanner

Recent Posts

10 Best Practices to Prevent Failures in ERP Evaluation, Purchase and Implementation

Posted by Michelle Tanner on Thu, Jun 05, 2014

Tags: SQL database, SQL

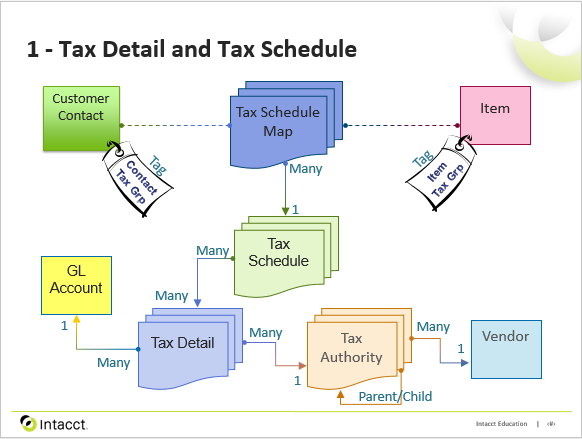

Tags: sales tax, sales and use tax, Intacct

April 18, 2014 – DALLAS – B Terrell Group is pleased to announce that Intacct Corp. named them one of its first Premier Partners. To achieve this level of recognition from Intacct, B Terrell had to complete many stringent requirements. These include having at least two certified Intacct consultants and a certified demo champion on staff.

Tags: Intacct, Intacct premier partner