Outsourcing payroll processing, payroll tax remitting, and related tax duties to a third party can be a great idea for many companies; however, I encourage our Workforce Go! clients to stay on top of the rules related to third party payer arrangements set by the IRS in section 16 of Circular E, whether they choose to outsource the responsibility or not. To reinforce the importance, I am summarizing the main points for you in this blog post.

Read MoreBTerrell Group Blog

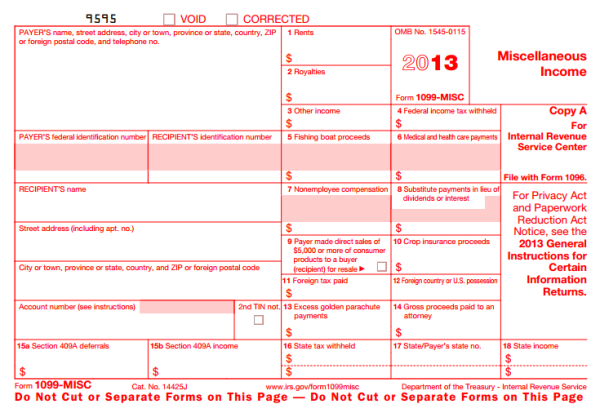

1099 reporting only happens once a year, so it is no surprise that we all forget the process to get these forms printed and distributed in a timely manner. Here's a quick link to our post from last year on Common Questions Re: Genertaing 1099-MISC Forms from Sage 300 ERP.

Read MoreTags: 1099

If anecdotal evidence counts for anything, the IRS may be stepping up their efforts at Form 1099 annual filing compliance. Recently, we heard of one mid-sized company that was fined around $25,000 for not completing the Recipient's Name correctly in an electronically filed batch. $25,000 is a lot of money, especially when it relates to a batch of 40 or so records. Do the math...that's $625 per form. Perversely, it seems that maybe they were just trying to ensure that the fine was greater than the annual filing baseline of $600 in service payments (and a host of other types of payments). Actually, they were following a formula that mandates a per form penalty for various offenses starting at $30 per form up to $250 per form. The maximum penalty starts at about $500,000 for small businesses, but there is no maximum under certain conditions. Payer beware!

Tags: 1099, 1099 reporting, 1099 compliance, aatrix