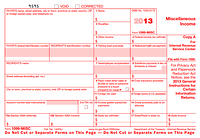

If anecdotal evidence counts for anything, the IRS may be stepping up their efforts at Form 1099 annual filing compliance. Recently, we heard of one mid-sized company that was fined around $25,000 for not completing the Recipient's Name correctly in an electronically filed batch. $25,000 is a lot of money, especially when it relates to a batch of 40 or so records. Do the math...that's $625 per form. Perversely, it seems that maybe they were just trying to ensure that the fine was greater than the annual filing baseline of $600 in service payments (and a host of other types of payments). Actually, they were following a formula that mandates a per form penalty for various offenses starting at $30 per form up to $250 per form. The maximum penalty starts at about $500,000 for small businesses, but there is no maximum under certain conditions. Payer beware!

If anecdotal evidence counts for anything, the IRS may be stepping up their efforts at Form 1099 annual filing compliance. Recently, we heard of one mid-sized company that was fined around $25,000 for not completing the Recipient's Name correctly in an electronically filed batch. $25,000 is a lot of money, especially when it relates to a batch of 40 or so records. Do the math...that's $625 per form. Perversely, it seems that maybe they were just trying to ensure that the fine was greater than the annual filing baseline of $600 in service payments (and a host of other types of payments). Actually, they were following a formula that mandates a per form penalty for various offenses starting at $30 per form up to $250 per form. The maximum penalty starts at about $500,000 for small businesses, but there is no maximum under certain conditions. Payer beware!

In another case, a Payer filed forms electronically and in perfect condition, but 16 days late. For that, the penalty was the minimum of $30 for the 11 forms, or $330. As this penalty was assessed on a per form basis, one is tempted to consider the disincentive of filing more forms. Actually, the disincentive properly applies to filing incorrect or late forms, but I don't remember these types of penalties being consistently applied in the past. Worse, sequestration has taken its toll on the IRS, and they do not have sufficient manpower or automation to promptly fine a small business. So, in this second case of the $330 fine, the fine was assessed in August 2013 for forms filed 16 days late in April 2012. Do the math again...that's 16 months from offense to fine, which significantly diminishes the educational effect of compliance enforcement. In other words, if I am doing it wrong then I may continue to do it wrong until I am notified that I am doing it wrong. How many cycles must I fail until I learn of my failure?

What's the answer?

Even though both Sage and Intacct have everything one needs to accurately file a Form 1099 (paper or electronic), I think it is time for small businesses to outsource IRS compliance issues. Small businesses must ask others to complete their tax and information returns. Tax compliance services and CPAs understand and meet the requirements in a ridiculously inexpensive way. For example, Aatrix, a BTerrell Group partner, will file my 1099s and W-2s for less than $2 per form. I still need Sage and Intacct to calculate the amounts, but I can outsource the risk of filing incorrectly or late and gain the peace of mind in knowing that if something goes wrong, I have someone in my corner.

As Congress requires the IRS to do more and more under the Affordable Care Act with less and less resources, it makes sense to get help on tax compliance. I can still do my own payroll and I can still write my own vendor checks, but when it comes to complying with quarterly and annual reporting requirements to the IRS, I think I am better served by letting my CPA or some other service do the compliance work for me!

Interested in learning more about eFiling with Aatrix? Call BTerrell Group at 866.647.2611 to receive an Aatrix quote specific to your business.