They say that pain is the touchstone of all spiritual growth. Maybe of business growth, too. A CFO at a major client experienced some real challenges around the normally unremarkable task of Form 1099 compliance that taught both her and me some best practices on this subject. I thought I'd share them here.

Read MoreBTerrell Group Blog

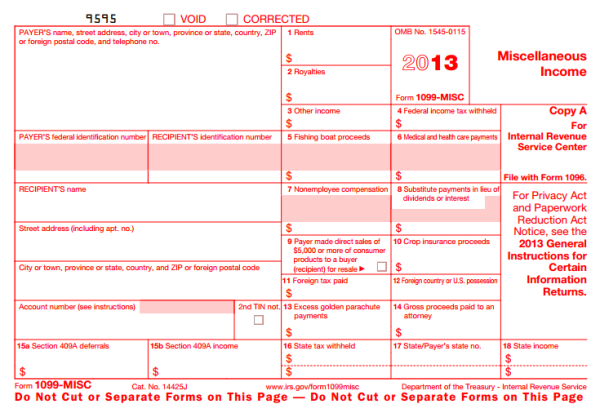

Form 1099 Compliance Best Practices…It’s that Time of the Year Again!

Posted by Brian Terrell on Tue, Jan 27, 2015

Tags: 1099 compliance

If anecdotal evidence counts for anything, the IRS may be stepping up their efforts at Form 1099 annual filing compliance. Recently, we heard of one mid-sized company that was fined around $25,000 for not completing the Recipient's Name correctly in an electronically filed batch. $25,000 is a lot of money, especially when it relates to a batch of 40 or so records. Do the math...that's $625 per form. Perversely, it seems that maybe they were just trying to ensure that the fine was greater than the annual filing baseline of $600 in service payments (and a host of other types of payments). Actually, they were following a formula that mandates a per form penalty for various offenses starting at $30 per form up to $250 per form. The maximum penalty starts at about $500,000 for small businesses, but there is no maximum under certain conditions. Payer beware!

Tags: 1099, 1099 reporting, 1099 compliance, aatrix