They say that pain is the touchstone of all spiritual growth. Maybe of business growth, too. A CFO at a major client experienced some real challenges around the normally unremarkable task of Form 1099 compliance that taught both her and me some best practices on this subject. I thought I'd share them here.

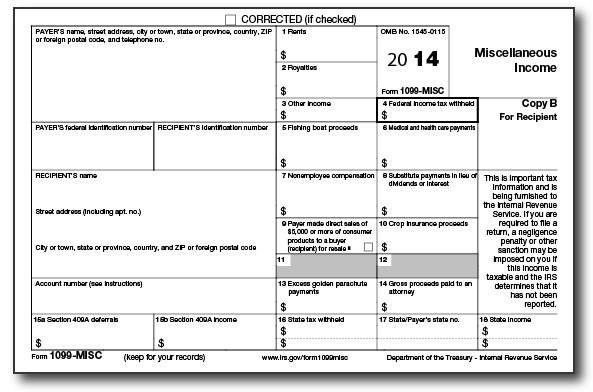

In 2013, this CFO received a $27,000 penalty notice based on her mid-market company's 2012 filing of just over 400 Form 1099s. That works out to about $60 per form, which sounds within reason as the IRS quotes penalties of $30 per IRS copy and $30 per payee copy. And, each of these penalties accrues independently of the other! The penalty notice based the fine on "failure to file electronically" and tax identification number (TIN) mismatches with legal names. The IRS requires electronic information return filing when the volume equals or exceeds 250 forms, so now we know they are serious about this. After two pleading letters, the CFO persuaded the IRS to abate the penalty for failure to file electronically.

That left the TIN matching fine, for which she also received grace based on her quick mailing of "B" notices to the appropriate vendors. The IRS requires payers to send “B” notices within 15 days of receipt of a CP2100 or CP2100A Notice. You remember the CP2100 notices, which the IRS mails payers who file a 1099 with a TIN the agency cannot reconcile to the legal name. Because my client's CFO sent out “B" notices quickly, the IRS agreed to waive the remainder of the $27,000 fine. This seems like a pretty good ending, but none of us needs this type of heartache in our finance and accounting lives.

Thus, out of pain comes these Form 1099 compliance best practices:

Pay no vendor before receiving a properly completed Form W-9

A Form W-9 provides provides the first line of defense to payers who rely on that form to provide a TIN and Legal Name for information return filing purposes and for an exemption from information reporting/backup withholding requirements. Collecting Forms W-9 from all vendors prior to payment makes good business sense. The IRS exempts most corporations from backup withholding, but how will you know unless the payee tells you by responding to your request for a properly completed Form W-9? You cannot treat a company as an exempt organization just because they have the name “Company” or the abbreviation “Co.” in their legal name. Ask for a Form W-9, and ask for it every year as businesses change their organization and structure from time to time.

Respond quickly to the receipt of a CP2100 Notice or a CP2100A Notice with a "B" notice

A payer sends a “B” notice to any payee to inform them they may have to begin withholding 28% out of every payment unless the payee provides a correct TIN and legal name or otherwise certifies they are exempt. The IRS requires payers to send "B" notices within 15 days of receipt of a CP2100 or CP2100A. Moreover, payers must begin backup withholding no later than 30 business days after the CP2100 notice date or receipt date, whichever is later. Publication 1281 provides the details. As my friend and client CFO discovered, hustling here can mean the difference between paying an IRS penalty or receiving a waiver for TIN matching errors on filed information returns.

Enroll in and use the IRS TIN Matching Program

The IRS provides an online mechanism to confirm the information returned on a Form W-9. If I validate all TIN and legal name combinations using this service, and I keep records of that fact, the IRS will forgive TIN matching problems on filed information returns as long as they receive them by the due date and are otherwise properly completed. Believe it or not, my client company referenced here received a $6,800 fine in 2014 for TIN matching issues but had records proving the numbers had been validated using the TIN matching service. Once presented with this evidence, the IRS waived the fine. Among other things, this suggest the IRS continues to check on a payer once they "have your number." In other words, it looks like the 1099 dog house to me. Just sayin'.

Complete the 1099 Legal Name field in your A/P software

Most software Accounts Payable applications include a field for “1099 legal name,” which populates the 1099 record for TIN matching purposes. This allows a payee to send invoices using one name (a happy, marketing name designed to thrill a payer into paying the bill), and a payer to report using the name matching the TIN in the IRS database. Both Intacct and Sage 300 ERP have the 1099 legal name field. Again, just sayin'.

Assume all payees require a 1099 until proven otherwise

Nowhere does this blog say that my client and friend received a penalty for filing too many 1099s. Neither does this blog advocate filing inaccurate information with the IRS. However, filing an otherwise accurate information return on an exempt corporate payee who failed to respond to a Form W-9 solicitation hurts no one. And, soliciting W-9s as a part of the new vendor workflow accustoms the entire staff to the habit of setting up a vendor for 1099 compliance reporting. Once a payer receives a Form W-9 certifying the payee as exempt, categorize that vendor in such a manner that filters them from receiving the form. If a payer follows Best Practice #1 above, that payer will file only accurate returns.

One other piece of advice: outsource the form filing effort. Two good services for this are Tax1099.com and Track1099. Quit buying forms, envelopes and stamps. You will want to collect an email address because these services best pricing requires electronic delivery. But, they'll perform complimentary TIN matching on the data, eliminate the need for a Form 1096, and keep track of IRS and electronic delivery status. Best of all - they let you and your staff be about the business of winning new customers and servicing existing ones. And, that's the ultimate in best practice!

For more information, please contact us. The general instructions for Form 1099 can be helpful, too!