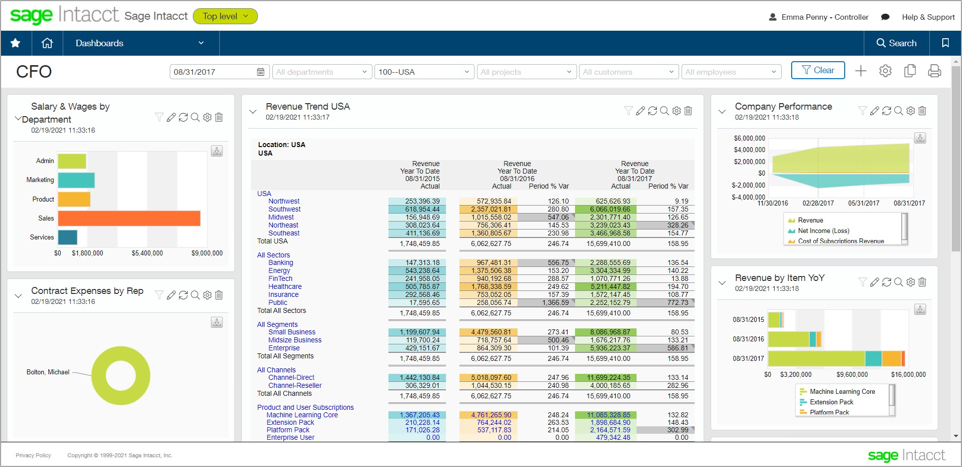

Potential stakeholders find it incredible that CFOs relying on QuickBooks and Excel can make fully informed financial decisions quickly, and this 1 minute and 57 second video explains how to repair the damage:

Read More

Tags:

Quickbooks upgrade,

Intacct,

Quickbooks,

outgrown Quickbooks,

Sage Intacct,

BTerrell SmartSuite

You've seen

Top Gun:Maverick

but you missed the warning it gives you about your continued use of Quickbooks or a legacy, on-premises accounting application. Invest 2 minutes and 1 second in this video which explains everything:

Read More

Tags:

Quickbooks upgrade,

Intacct,

Quickbooks,

outgrown Quickbooks,

Sage Intacct,

BTerrell SmartSuite

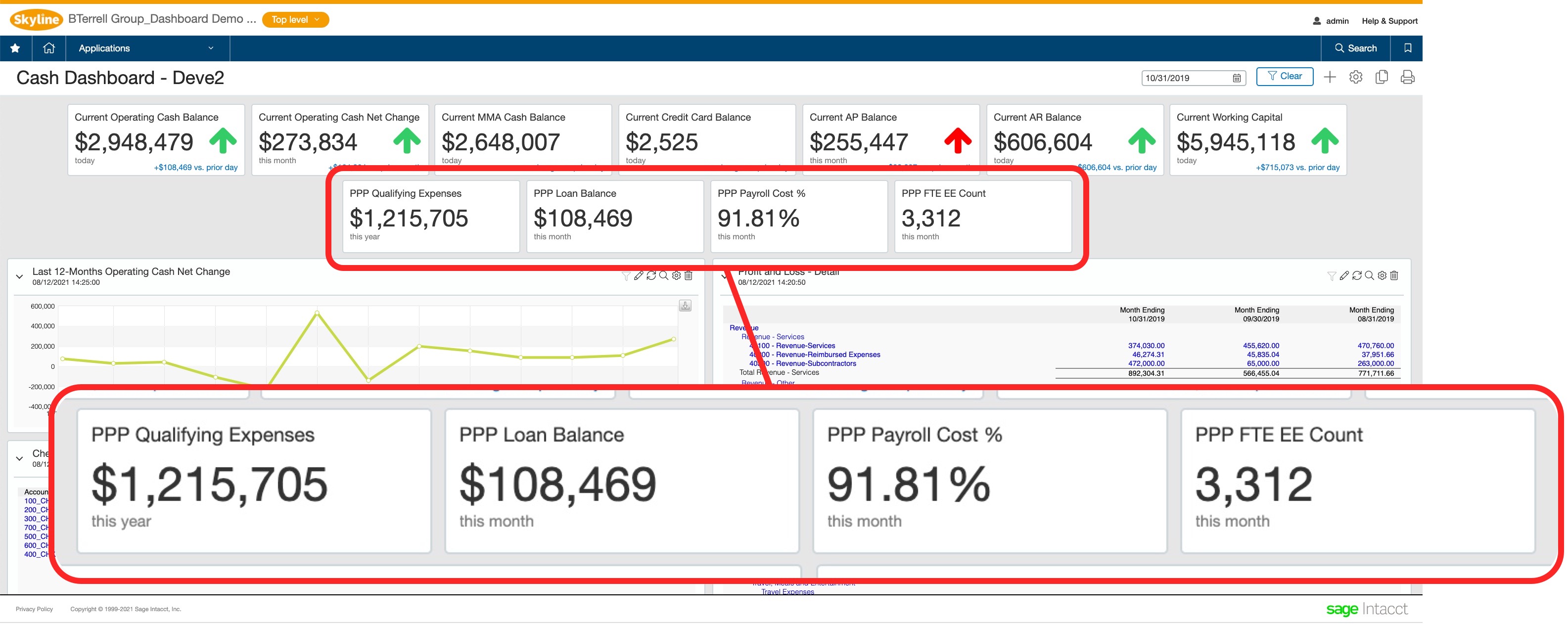

Did Quickbooks instantly update you on your eligibility for

Paycheck Protection Program

loan forgiveness? This 3 minute and 27 second video explains exactly how Sage Intacct did this for BTerrell SmartSuite Members:

Read More

Tags:

Quickbooks upgrade,

Intacct,

Quickbooks,

outgrown Quickbooks,

Sage Intacct,

BTerrell SmartSuite

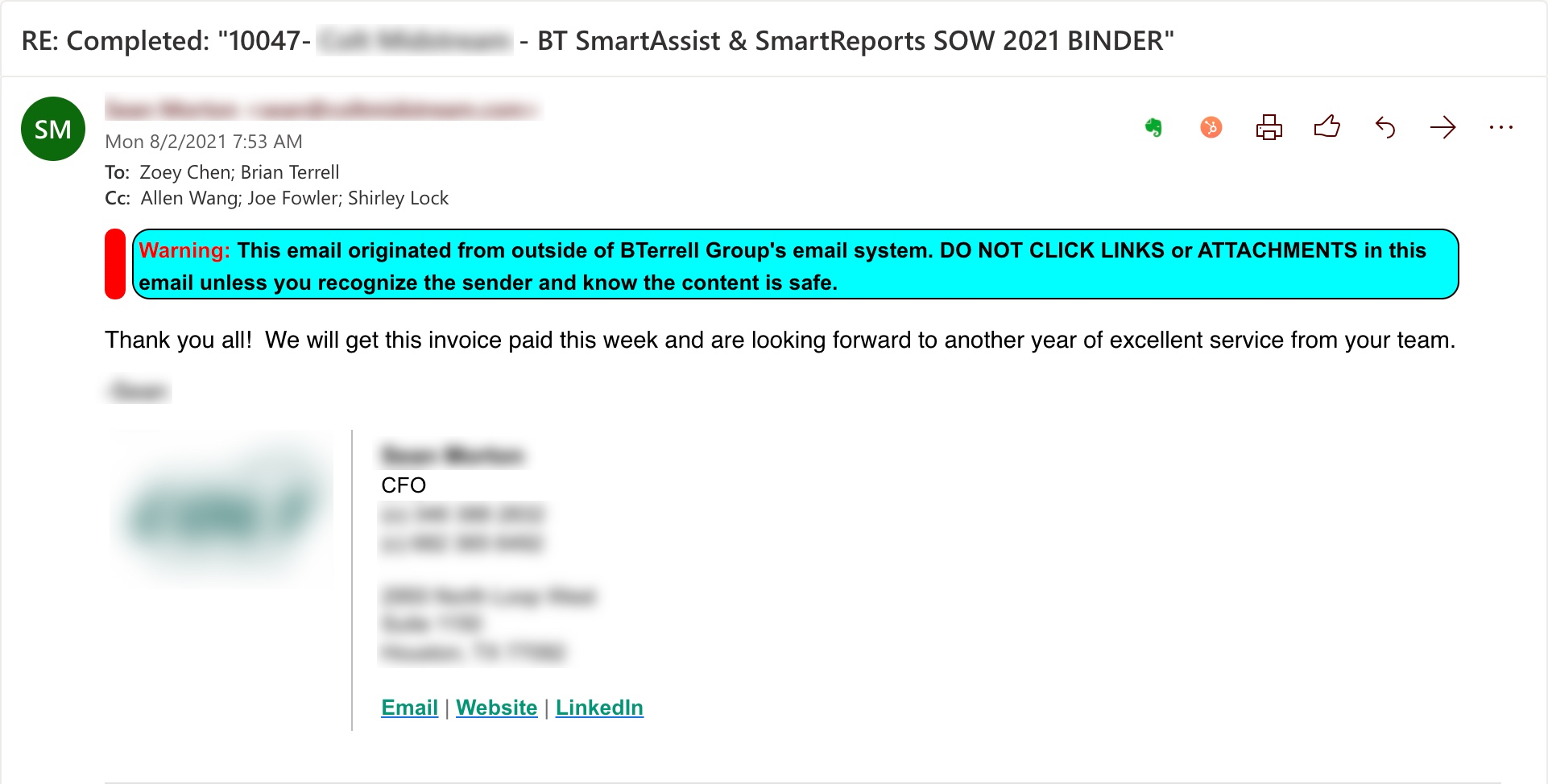

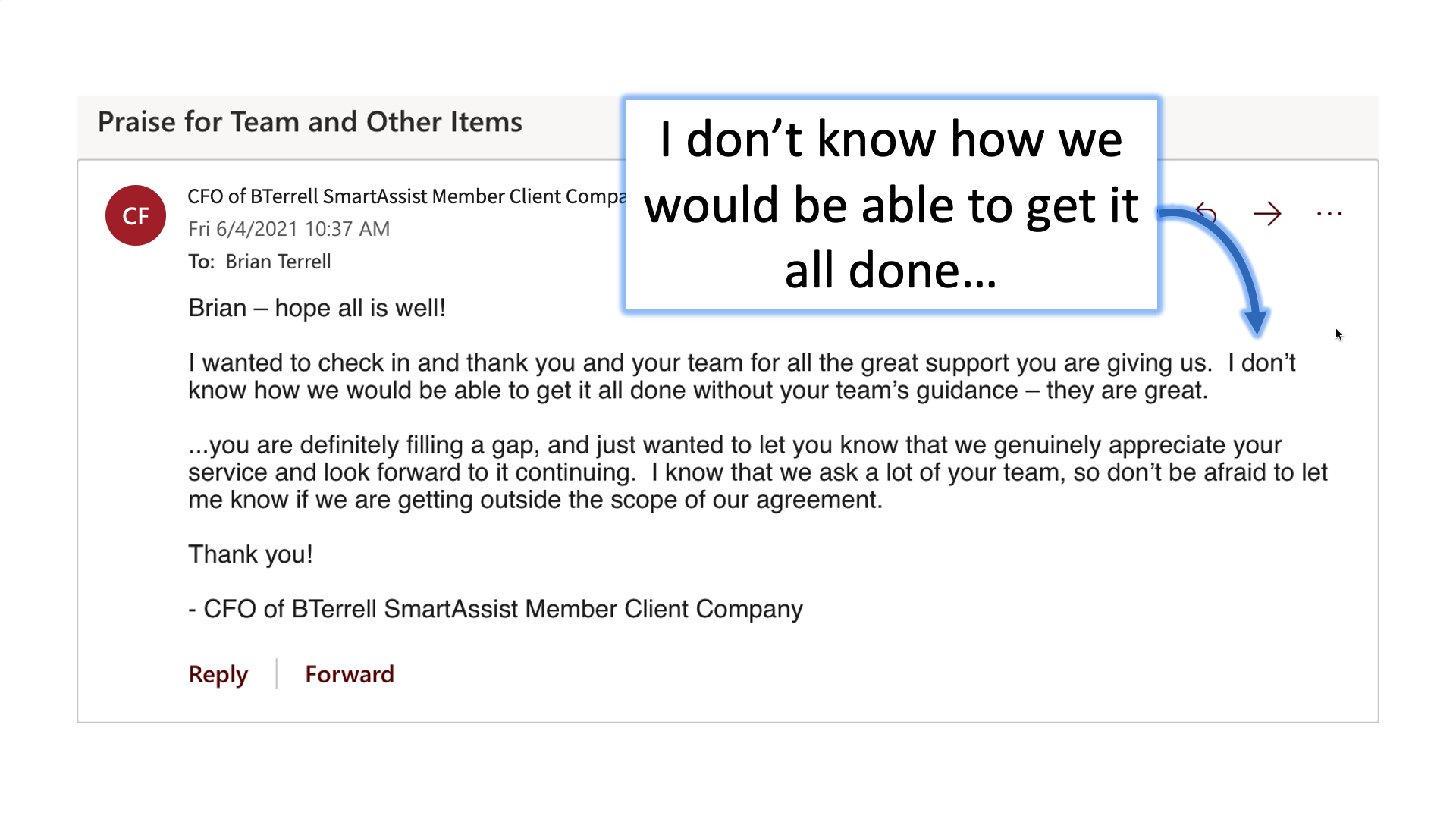

You'll never have to ask for a reference from us, as we give those early and often. Here's an unsolicited email I received out of the blue in August 2021 while on vacation with my grandkids in Wisconsin. Please invest 2 minutes and 46 seconds to learn exactly why BTerrell SmartSuite Members are so happy to do business with us:

Read More

Tags:

Quickbooks upgrade,

Intacct,

Quickbooks,

outgrown Quickbooks,

Sage Intacct,

BTerrell SmartSuite

You'll typically pay at least $15,000 to $20,000 annually for a software subscription plus 1 to 1 and 1/2 times that amount to configure the software, convert your data, and train your users when you upgrade from Quickbooks to Sage Intacct. This video shares exactly how you can convert those large costs into a manageable, monthly fee and receive continuous, unlimited, and ongoing value in the form of training, support, and report/dashboard design and development services:

Read More

Tags:

Quickbooks upgrade,

Intacct,

Quickbooks,

outgrown Quickbooks,

Sage Intacct,

BTerrell SmartSuite