Do you process Receipts and/or Payments via Electronic Funds Transfer?

Do you need to reduce your payment processing costs?

Do you process Direct Debits from customers or Customer Refunds?

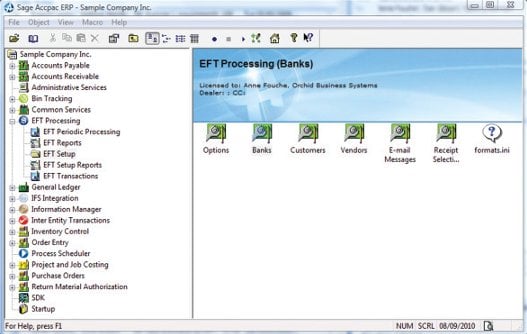

If so, you might benefit from Orchid's EFT Processing solution! It streamlines payment and collection processes and tightens control over bank transfers. EFT Processing transfers Accpac receipts and payments through to the electronic funds transfer functionality of your banking software.

The Benefits of EFT Processing:

- Reduced bank transaction fees.

- Process both receipts and payments.

- No duplicated data entry, saving time and eliminating errors.

- Expensive check stationery not required.

- Improved security on vendor/customer bank account details.

- Improved security on issuing checks – no checks lost in the post.

- Reduced postage costs as you can email remittance advices.

- Reduced processing time, instead of taking several hours to print, fold and post cheques - an EFT batch can be created, imported and remittances emailed in a matter of minutes.

- Environmental benefits through the reduced use of paper.

EFT Processing Features:

- Automatically creates EFT files required by the bank, for both payments and receipts.

- Creates Electronic Funds Transfer files in the format required by many major banks based on the standard Sage ERP Accpac Accounts Payable payment and customer refund routines.

- Creates Electronic Funds Transfer files for receipts (direct debits) from customers using receipt batches.

- Holds vendor and customer banking details.

- Optionally stores vendor’s bank account details by remit-to code.

- Optionally stores vendor and customer bank account details by Payor Bank.

- Works with numerous Bank formats worldwide. User definable Bank formats and screen labels to reflect Bank terminology.

- Summary transaction log.

- Audit log of changes to Vendor and Customer bank account details.

- Remittance advices can be emailed using standard Accpac functionality.

- Elect to work with posted or unposted batches.

- Automatically create customer receipts and bank files from AR invoices.

- Automatically create AR Receipts from transaction balances.

- Select by document date, due date, customer range, customer group, customer optional field.

- The ability to have an e-mail cc to keep copies of e-mail remittance advices.

- Select from a range of batches or selected entries within a batch.

- Define default remittance advices.

- Approval process with enhanced security for amending customer and vendor bank account details.

- When generating bank files, optionally elect to skip or error on vendors or customers who are not defined in EFT Processing.

- Developed in the Accpac SDK providing Accpac look and feel.

Standard Accpac security, customization capabilities, data integrity checking, web mode and more! - Runs on all databases supported by Accpac.

- Supports Customer Number Change and Vendor Number Change.