Back in April of 2010, the Financial Accounting Standards Board published new accounting guidance for calculating an often challenging method for recognizing payments on certain forms of revenue. Published as “ASU 2010-17: Revenue Recognition – Milestone Method (Topic 605)”, and discussed in draft abstract form in “EITF 08-9: Milestone Method of Revenue Recognition” on RevenueRecognition.com, the method allows vendors to recognize revenue at the time that a contractual obligation has been fulfilled, instead of applying revenues systematically throughout the term of the contract. However, because of the complexity of dealing with contractual incentives, such as bonuses, the milestone method outlines a few criteria that must be met.

Read MoreBTerrell Group Blog

Tags: Intacct, revenue recognition, ASC 606

The new Revenue from Contracts with Customers (ASC 606) accounting guidance impacts companies across many industries, but companies that sell software and related products or services will likely experience some of the biggest changes. In our ongoing attempt to help businesses make sense of this complex topic, we’ll look at the ways in which ASC 606 may change the way software and cloud services companies do business.

Tags: revenue recognition

We’ve got answers.

ASC 606, Revenue from Contracts with Customers, represents the most sweeping accounting change to hit companies in decades. Whenever there are changes this significant, there are bound to be questions. In our continuing look at the new revenue recognition standards, we attempt to answer some of the most common questions we are hearing from our clients and prospects.

Read MoreTags: revenue recognition

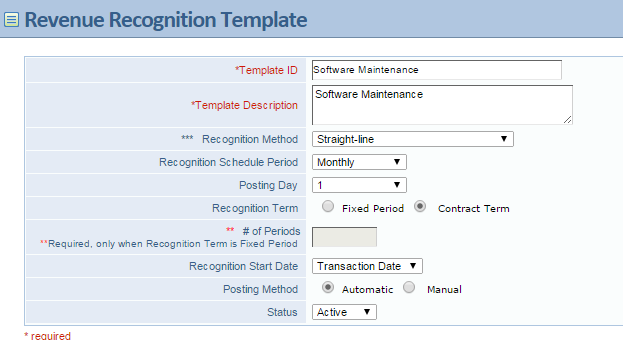

Some things in accounting are very frustrating, which make me sometimes doubt my career. Revenue Recognition is definitely tops the list; the multiple recognition methods, slow and complicated spreadsheets, and constant manual maintenance. I feel stressed even thinking about this. Even worse, is when I spot a mistake from a few months earlier.

Read MoreTags: revenue recognition

Tags: Intacct, revenue recognition