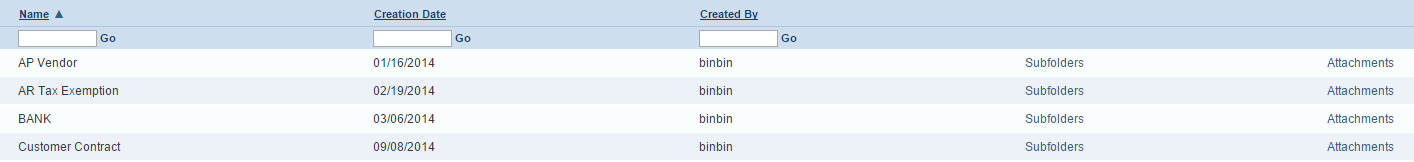

Are you tired of digging the invoices from piles of document? Are you desperate to go paperless and to save some trees?

Read MoreBTerrell Group Blog

Binbin Zhai

Recent Posts

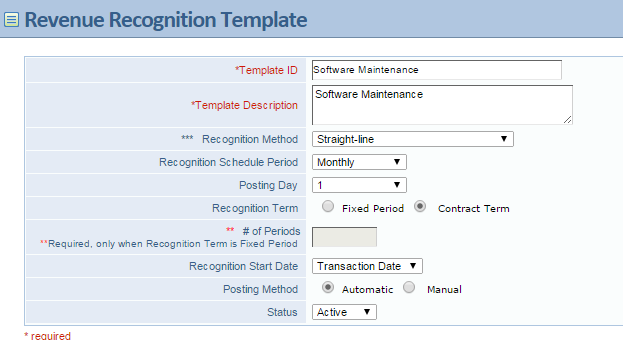

Some things in accounting are very frustrating, which make me sometimes doubt my career. Revenue Recognition is definitely tops the list; the multiple recognition methods, slow and complicated spreadsheets, and constant manual maintenance. I feel stressed even thinking about this. Even worse, is when I spot a mistake from a few months earlier.

Read MoreTags: revenue recognition

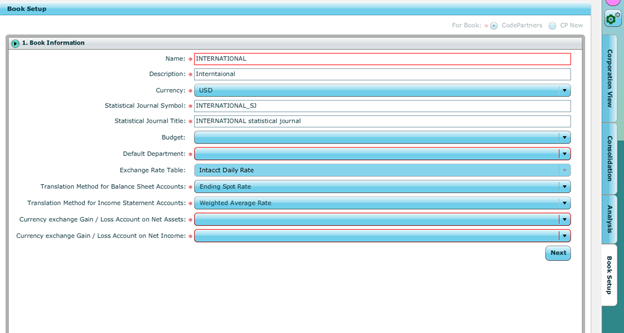

Global Consolidation is one of the awesome features of Intacct. As it automatically pulls the daily exchange currency rate into each transaction, you can run any report at any time in US dollars or other currency. No more running complicated manual calculation or spreadsheet so giant that it makes your computer run slow. Even better, it is very easy to set up.

Read MoreTags: Intacct, global currency