We try to understand our prospects, customers and their issues as best we can. Being a professional services firm ourselves, we intimately understand the financial challenges associated with sharing our expertise -- via consulting engagements -- to our valued customers.

In this article, I want to analyze the specific pain points of financial management within professional services organization, discussing:

- What are the primary concerns of CFOs from professional services companies?

- What are some of the repercussions of these issues?

- Why BTerrell Group chose to utilize Intacct to help relieve these pain points for our own internal financials, and why Intacct is such a great fit for our customers who are professional services firms

Pain Point #1: Complex billing terms and schedules

For consulting and services organizations, every customer truly is different. Complexities include things such as:

- the scope of the project

- the negotiated terms of the engagement

- project milestones and schedules

- performance-based or time-based payment schedules

These different complexities often lead to manual, off-line project tracking and reporting, with much of the details manipulated in Excel spreadsheets. This creates inefficiencies in reporting, reduced staff productivity, and ultimately lower profitability. Think about how much time is wasted in your firm. If only 10% of a full-time employee's time is wasted in this area (at a salary of $120K/year, for instance), that's $12,000 a year down the drain due to inefficiency...yikes!

Need: Consistent view of project specifics with appropriate visibility to key stakeholders in the service delivery lifecycle

Pain Point #2: Capture of all billable and non-billable time and expenses

Ad-hoc time and expense capture is a huge issue for professional services firms. Reporting consistency is critical to give visibility to the financial and operations areas which may be improved for the productivity and profitability of the firm.

Revenue leakage and lower project profitability are huge concerns, due to the inability to capture all billable time and expenses. In addition, project and cost over-runs can result in more non-billable work time (think about the price per hour per consultant), along with non-recoverable costs that can be incurred by not capturing all this information in a timely manner.

Need: real-time, streamlined time and expense management for project control and profitability

Pain Point #3: Proactive cash flow management, along with proper recognition and deferral of project-based revenue

Without proper processes and communications across and through the organization, it's really difficult to manage cash flow proactively in professional services firms. Unless Finance knows that project milestones are slipping, for instance, it's almost impossible to plan for receivables and cash flow. In addition, delays in reporting can have a substantial impact on revenue forecasting, budgeting and overall financial - and operational - decision-making.

Need: Automated project billing and revenue management system

Pain Point #4: Financial visibility into project status and key metrics

People are busy working on their priorities. We get it. But, because Sales is busy selling, and Project Management is busy managing their projects, many times Finance doesn't have real-time information on projects or customers to be able to provide the reporting and financial management necessary to run the business. Billing cycles can be sluggish, as invoices are often contingent upon the communication of the completion of a project or milestone.

Need: Automated system to track performance of project milestones and costs to ensure accurate and efficient billing, revenue recognition and collections

In essence, finance pros in professional services firms need a 360-degree view of the business for reporting and decision-making purposes. The only way to do this effectively is by implementing a system combining time and expense management, project tracking and financials. This system needs to be easily customizable for your business, easily accessible by all employees, have the right permissions-based access per employee, be robust enough to scale with your business, yet be flexible enough to provide all reporting when, where and how you need it.

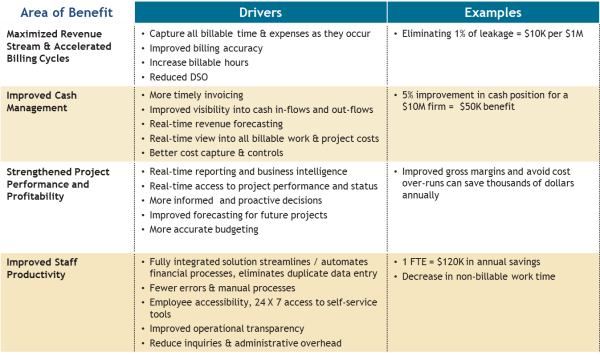

For our business, we chose Intacct to do just that for us, and we're so glad we did. Here are just some of the key areas of benefit, drivers, and examples of benefits provided:

Think about this for your business. Could you benefit from any - or all - of the following?

- Maximized revenues and accelerated billing cycles

- Improved cash management

- Strengthened project performance and profitability

- Improved staff productivity

Feel free to contact us for a free 30-minute consultation. BTerrell Group can help you determine if Intacct is the right solution for your business.