Let’s face facts. There is no shortage of ERP solutions on the market. As a result, I regularly hear questions from companies about the difference between one system and another. Here are three of the most frequently asked questions I hear about the difference between Intacct and Microsoft Dynamics GP (“GP”) and what I’ve found to be true.

Read MoreBTerrell Group Blog

Keith Karnes

Recent Posts

Three Questions Differentiating Intacct and Microsoft Dynamics GP

Posted by Keith Karnes on Wed, May 27, 2015

As a provider of a best-in-class financial cloud solution, we know the advantages and benefits of the cloud, but we also know how overwhelming it can be when companies begin the search for a new cloud vendor.

Read MoreTags: cloud computing, Intacct, cloud, new cloud vendor, financial cloud solution

How to Know It is Time to Consider Implementing a New Financial Management Solution

Posted by Keith Karnes on Fri, Mar 20, 2015

While there is no magic formula that calculates a company’s readiness for a new financial management solution, there are warning signs to be aware of in your business.

Read MoreTags: Intacct

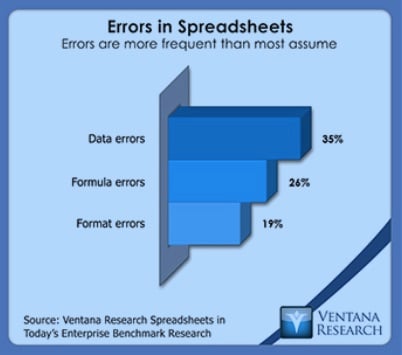

In a previous post, I covered that spreadsheets, while easy to use and familiar, pose many financial risks for companies and lead to costly financial mistakes. As a follow up, I want to explore three common processes that many small- and medium-sized businesses (SMBs) manage using spreadsheets and how they could be improved by replacing spreadsheets with a dedicated financial tool such as Intacct.

Read MoreTags: Intacct

Spreadsheets have become a way of life for many growing companies. With overwhelming workloads, many finance professionals rely on spreadsheets because they are easy to set up and familiar to them. Many times, it is easier to believe that familiar equates to an indispensable resource; however, I believe the tool finance professionals choose should not just be familiar. I believe the tool should reduce risk of financial errors, streamline processes, and allow rapid delivery of critical financial information, ultimately freeing up time for finance leaders to focus on strategic initiatives and big picture goals.

Read MoreTags: Financial Reporting