BTerrell Group Blog

Chris Firra

Recent Posts

Tags: Sage 300 ERP, Intacct

Tags: Sage 300 ERP

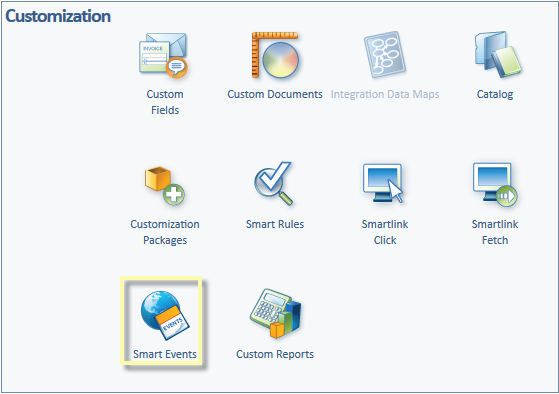

Recently, I've learned about what I believe are two of the best features of Intacct Platform Services, Smart Rules and Smart Events. These tools add logic, data validation and control to the core Intacct applications without writing complex code. With this entry, I want to share my experience with Smart Events. To learn more about Smart Rules, I'd suggest visiting the excellent blog posting by Joe Zhou from our sister company, CodePartners, entitled How to Create Intacct Smart Rules.

Tags: Intacct

An on-line version of Sage 300 ERP has now been available for over ten years. Side-stepping the semantic question of whether Sage 300 Online is truly a "cloud application", it is certainly a true statement that the on-line application has been since its inception a hosted version of the award winning on-premises accounting software, offering all of the same functionality. Because it is remotely accessible using a MS Windows computer and internet browser, it offers all of the benefits of a SaaS-based, cloud application.

Tags: Sage 300 ERP, Sage 300 Online

We live in an age when each new software product has an “API” or application programming interface that allows connectivity with other devices and systems. The API concept powers the latest home and consumer electronics features that we love such as remote control of NEST thermostats, online exercise tracking like FitBit bands, and a host of functions on smart TVs. Likewise, modern accounting systems utilize their APIs to communicate with “connected services” that extend the functionality of the core products.

Tags: Intacct