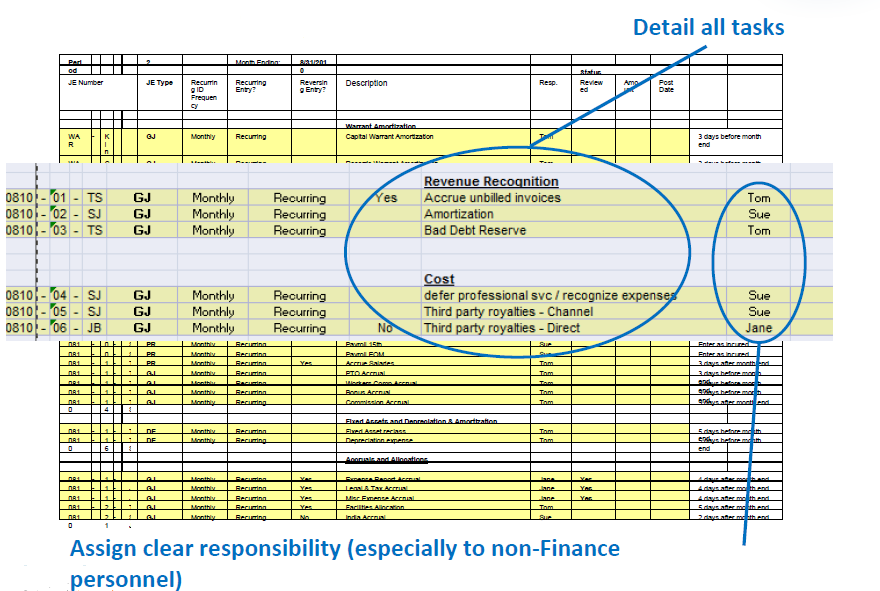

In many ways, performing an effective monthly financial period closing is similar to carrying out a successful implementation project. Each closing requires a good plan, effective communication among participants, someone that can control activities and risks, and ideally, a review at the end to learn from mistakes and identify opportunities for improvement. Like a project, a closing must adhere to a defined schedule and meet quality objectives for the deliverables, that is, financial statements that accurately portray results and are free of material errors. The personnel, systems, and processes are equally essential.

Read MoreBTerrell Group Blog

Chris Firra

Recent Posts

Tags: Financial period closing

Three Common Reasons for Not Doing Implementation Acceptance Testing

Posted by Chris Firra on Tue, Oct 07, 2014

User acceptance testing is an extremely important part of a successful accounting system implementation. The testing phase is typically carried out just prior to live deployment, and if done correctly, it eliminates the risk of failures in critical business functions that depend upon new accounting systems. Despite this, there are always pressures to reduce the scope and depth of testing. Here are a few commonly cited reasons:

Tags: successful software implementation, software testing, implementation

Tags: sales and use tax, Intacct

Much has been recently written about the OpenSSL bug known as "Heartbleed", which is a vulnerability in the HTTPS protocol for Apache and nginx web servers. The vulnerability could allow unauthorized users to read unencrypted web traffic, including passwords. Early stories circulated that as much as 2/3 of the Internet was affected by the bug. According to the latest articles, it likely had a much smaller impact. However, the defect was found to have effected some of the largest providers of Internet and cloud-based services, such as Amazon, Google, Akamai, Blackberry, Tumblr and even the Canadian version of the IRS.

Tags: Intacct

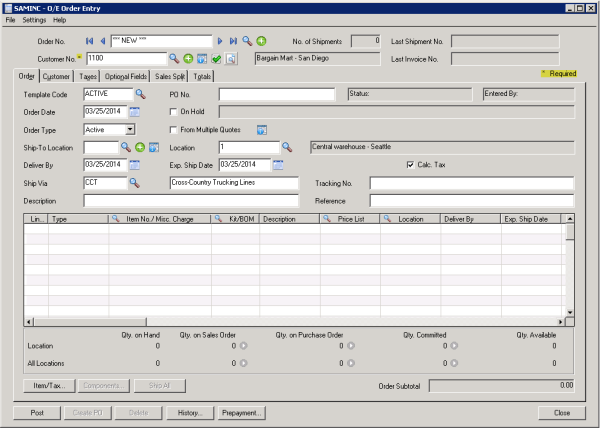

Last week, as anticipated, Sage officially announced general availability of Sage 300 ERP version 2014. I attended the business partner webinar that took place a day earlier, where I learned that the early release for developers and so called VIP customers was consistent with the latest version.

Tags: Sage 300 ERP