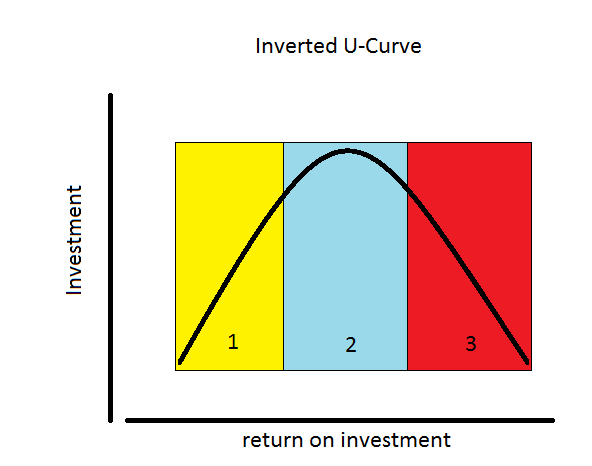

Malcolm Gladwell’s books always make me think, and his excellent writing makes the thinking easy. I’ve heard him criticized for tenuous and selective research. However, doesn’t the way he raises the level of popular discussion and ultimate understanding of an issue go a long way to mitigate those concerns? Regardless, Mr. Gladwell’s recent David and Goliath asserts that too much of a good thing, as represented graphically by the inverted u-curve, applies to areas we might not expect, such as smaller school class sizes, artistic marketplaces, and university choice, amongst others. But, I wonder if the inverted u-curve also applies to software customization?

BTerrell Group Blog

Tags: Sage 300 ERP, Intacct

Tags: Sage 300 ERP

Last week, as anticipated, Sage officially announced general availability of Sage 300 ERP version 2014. I attended the business partner webinar that took place a day earlier, where I learned that the early release for developers and so called VIP customers was consistent with the latest version.

Tags: Sage 300 ERP

Getting the Most Out of Sage 300 ERP data with Spreadsheets

Posted by Tony Zhang on Wed, Mar 26, 2014

Over the years, BTerrell Group has helped our clients improve their productivity using software systems and financial reporting. One of the products we really like is Spreadsheet Analyst (formerly known as Sage Accpac Insight), which is a terrific complement to Sage 300 ERP. Not only does this product help meet enterprise reporting requirements very well, but brings a lot of value to our customers. To help customers get the most value out of Spreadsheet Analyst, our own Chris Firra has developed an in-depth training curriculum that has helped numerous customers along the way.

Tags: Sage 300 ERP

Comparing/Contrasting Intacct & Sage 300 ERP: Which is Best for You?

Posted by Brian Terrell on Fri, Mar 21, 2014

Thanks to everyone who attended Wednesday's panel discussion in which Keith Karnes, President of BTerrell Group, and I compared and contrasted the two accounting software products BTerrell supports. We have 23 years of experience with Sage 300 ERP and nearly 4 years of experience with Intacct. If you were able to join us, we hope you learned a lot. If you had to miss it, these are some of the key points that were made.

Tags: Sage 300 ERP, Intacct