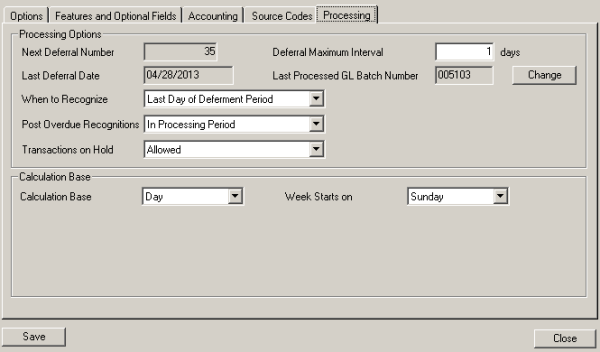

Revenue and Expense Deferrals for Sage 300 ERP (Accpac) by Systronics is a great add on module that integrates directly with Sage 300 ERP to provide revenue recognition capabilities. Let’s take a look.

Since the module integrates directly with Sage 300 ERP, it is very simple to configure. The UI will be very similar to the UI you may already be used to.

BTerrell Group Blog

Revenue and Expense Deferrals Add-On Module for Sage 300 ERP

Posted by Kevin Yu on Mon, Jun 24, 2013

Tags: Sage 300 ERP, Systronics, Revenue and Expense Deferrals

Systronics' Revenue & Expense Deferrals and ToolPac Webinar

Posted by Meredith Gooch on Mon, Jan 30, 2012

Join us for a Webinar on Systronics' Revenue & Expense Deferrals and ToolPac on Tuesday, January 31, 2012 at 3:00 Central.

Tags: sage erp accpac, Systronics, Webinar, ToolPac, Revenue and Expense Deferrals

Join us for a webinar hosted by Systronics to learn more about their Revenue & Expense Deferrals add-on for Sage ERP Accpac.

Tags: sage erp accpac, amortize transactions, Revenue & Expense Deferrals, Systronics

Systronics' Revenue & Expense Deferrals Webinar October 27, 2011

Posted by Meredith Gooch on Tue, Oct 25, 2011

Have you been wanting to see Systronics' Revenue & Expense Deferrals module in action? Now is your chance! Nancy Lavery will be leading a Webinar on Thursday, October 27th from 3:00 p.m. to 3:30 p.m. Central time.

Tags: Systronics Revenue & Expense Deferrals, Systronics, Revenue and Expense Deferral, Accpac Revenue and Expense Deferral