I recently started a blog series discussing some of the main reasons companies need to implement a new ERP system. Reason #1 can be found here. Today, I'll discuss Reason #2.

BTerrell Group Blog

When to Implement a New ERP System – Reason #2 Total Cost of Ownership Cannot be Justified for Your Current System

Posted by Keith Karnes on Thu, Jun 19, 2014

Tags: ERP, TCO, Total cost of ownership, implement a new ERP system, Intacct

When to Implement a New ERP System – Reason #1 Software Limitations of your Current System

Posted by Keith Karnes on Thu, May 15, 2014

I spoke with a CFO of a small, but growing business recently, and he asked me a simple question, “Why should I implement a new ERP system?” The answer is simple, robust, and one I explain quite frequently. That being said, I want to share, over the next several weeks, some of the main reasons I believe companies may need to implement a new ERP system.

Tags: software limitations, why implement new ERP system, software growing pains, ERP, Intacct

Recently, I attended an introductory meeting with a prospect for ERP consulting services. In short, this prospect shared a painful story around implementing and using a system very familiar to me. I know the software works for this prospect's business because our firm has been successful implementing and supporting it for many years for similiar companies. So, what caused this prospect to have an experience very different from the hundreds of happy users I know and with whom I do business?

Tags: ERP

There are great shortcuts to help you navigate Intacct quickly and efficiently. For those of you already familiar with Intacct shortcuts, I hope you learn at least one new shortcut to help you navigate Intacct more efficiently. For those of you who are not familiar, I hope you find the below lists very useful as you begin using Intacct.

Tags: Intacct Shortcuts, ERP, Intacct

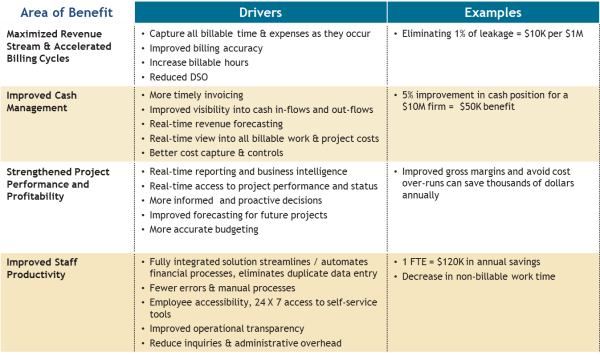

We try to understand our prospects, customers and their issues as best we can. Being a professional services firm ourselves, we intimately understand the financial challenges associated with sharing our expertise -- via consulting engagements -- to our valued customers.

Tags: ERP, Intacct, cloud, cloud erp, cloud accounting software