Over the last decade, we’ve seen a number of employee-friendly reforms go into effect. Paid family leave, higher minimum wages, gender pay equity, union-friendly rulings and healthcare reform have all received consideration attention – and legislative action. The new administration has promised to roll-back, or at least curtail, many of these changes, leaving employers wondering what to do and how to do it.

Read MoreBTerrell Group Blog

Anticipation, Preparation and Execution - What to do in a shifting HR landscape

Posted by Brian Terrell on Mon, Feb 13, 2017

Tags: hrms

Yesterday afternoon, the IRS issued Notice 2016-4, which provides unexpected relief to employers distributing those soon to be well-known Form 1095-C information returns to employees. This late Christmas present will be well received by every employer struggling with system update and information gathering challenges. Applicable Large Employers (‘ALE’) and insurance companies now have nearly two additional months to get forms in the mail to employees. This additional time applies not only to Form 1095-C but also to Forms 1094-B, 1094-C, and 1095-B. Who said there wasn’t a Santa Claus?

Read MoreTags: HR software, ACA, HR, hrms, Intacct, taxes, IRS, technology ready for ACA, SMB HR, ACA compliance,

Intacct delivers a Best-in-Class cloud accounting and finance application which easily integrates with other Best-in-Class cloud solutions like Salesforce, Avalara, Docassist, Nexonia, Orange Leap, and KeyedIn. These Best-in-Class software partners link to and share transactions seemlessly with Intacct using Intacct Platform Services or web services. However, one important area of business process and functionality seems missing from the mix – Human Resource Management.

Tags: Human Resources, hrms, Intacct, payroll

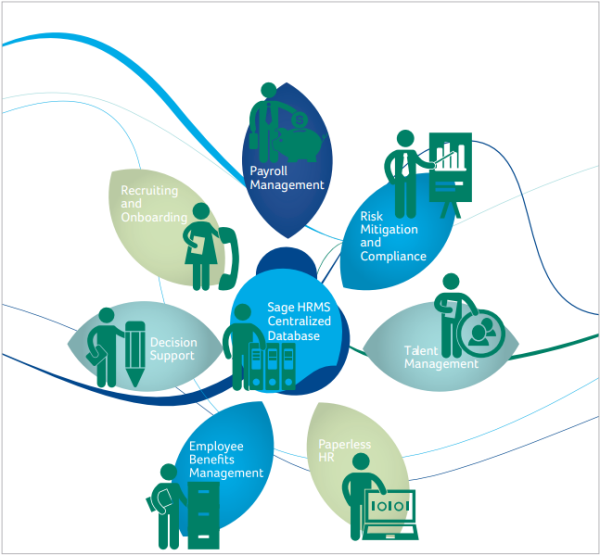

What is HRMS and how can HRMS help my organization?

- Does your organization spend too much time filling out and filing HR paperwork?

- Is there a need to store historical data for current and former employees?

- Do you wish there was one place to track historical and current pay rate, salary information, benefit and savings plans, as well as to record performance evaluations?

Tags: hrms, what is hrms, sage hrms